Weekly NASDAQ Model Update - Sep 13, 2025: +27% CAGR Since 1999 - Today’s Signals & Stance

Our Tactical NASDAQ Model turned $10K into over $6 million with 27% annual returns since 1999 - crushing the NASDAQ. This week’s update reveals the model’s current position, market signals, and more.

📅 Date: 13.09.2025

📣 Feature Announcement - Founders Get Long-Term Portfolio Access

I’m adding read-only access to my long-term stock portfolio for Founding Members: holdings & weights, one-page thesis cards, and a timestamped change log (adds/trims/exits). You’ll also see simple entry status badges on each name - 🟢 Accumulable • 🟡 Hold • 🔴 Extended - so you know whether fresh entries still make sense. Updates 🗓️ monthly.

🎁 Thank you: all current Yearly paid members will be upgraded to Founding Member at no extra cost.

The NDX rose +1.86% w/w to 24,092.19 (from 23,652.44), finishing 0.19% below the weekly high. The range ran from a low 23,698.00 (Tue) to a high 24,137.06 (Fri)—a 439-pt (~1.82%) swing—and price closed near the top of that band, signaling a constructive bias into the weekend. Implied volatility eased: the VXN slipped to 18.18 from 18.44 (≈–1.41% w/w), consistent with steadier risk appetite despite intraday chop. Net-net, tech leadership and easing vol supported a modest rebound; sustained follow-through now depends on broader participation and confirmation above the week’s high.

🔥 Still on the sidelines?

More than 250+ investors follow this model for one reason: proof. It’s documented, independently backtested, and built for end-of-day execution.

✅ ~29% CAGR since 1999 (third-party, 17-page backtest)

✅ Robust across dot-com, GFC, COVID, and 2022 (~+30% vs –38% Nasdaq)

✅ Lower drawdowns, fewer trades, and a simple EOD routine

“I didn’t need a story. The third-party backtest lined up with the live signals, and the end-of-day workflow fits my day job. I execute, not guess.”

— Mark R.

📊 No fluff. No noise. Just data.

Skeptical? Good. You should be. That's why we publish an independent backtest.

Same logic. Same signals. No black box.

📊 Backtest Results (1999-2025):

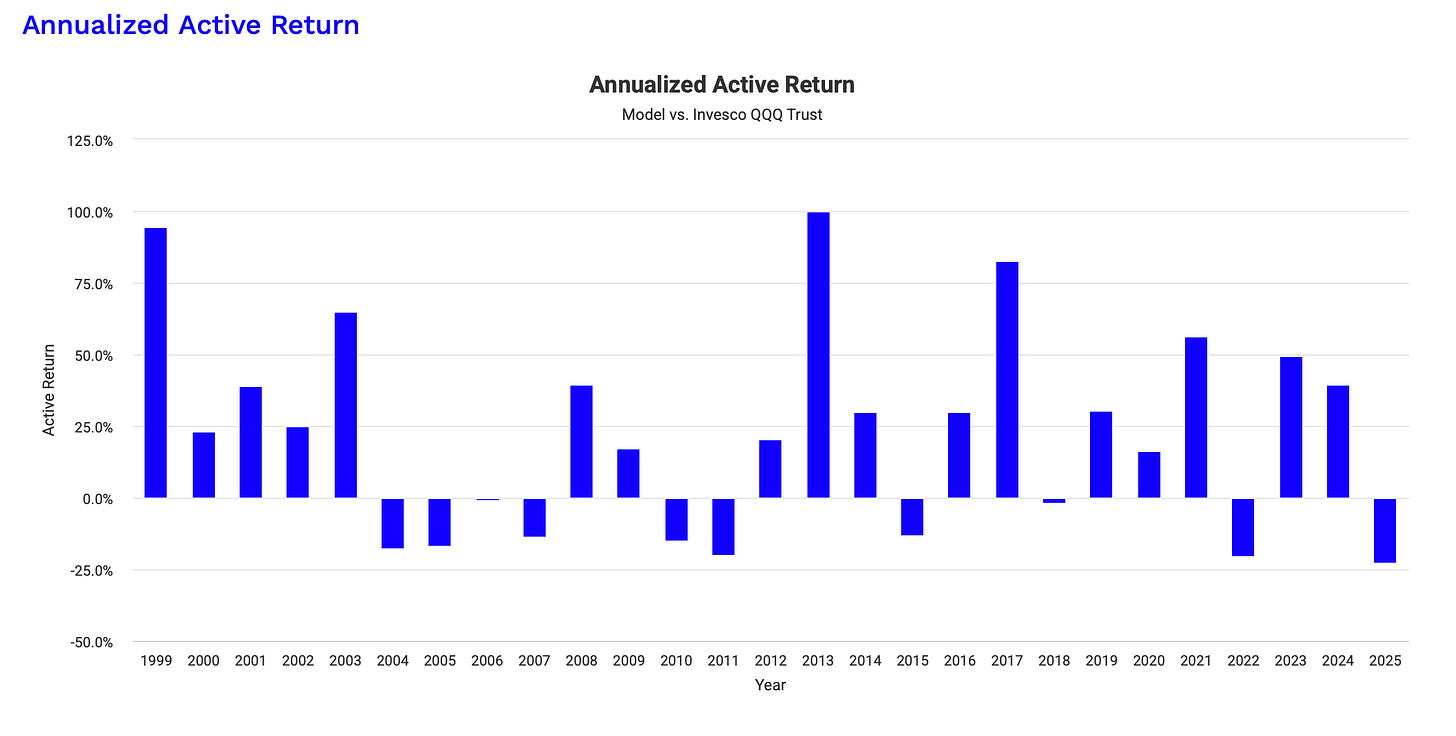

and the annualized outperformance for the last 25 Years compared to the QQQ:

If you're serious about compounding wealth with discipline, now’s the time.

🟢 $0.60 a day.

🟢 Cancel anytime.

🟢 Join hundreds who stopped guessing and started operating.

Let’s get into the allocation.

🔑 Paid Subscribers Only

💼 Current Portfolio Allocation

Here’s how the three models are currently positioned:

Keep reading with a 7-day free trial

Subscribe to The Nasdaq Playbook to keep reading this post and get 7 days of free access to the full post archives.